Kin Capital Launches $100M Tokenized Real Estate Debt Fund on Chintai, Bridging Traditional Finance with Blockchain Innovation

Singapore, Singapore, September 30th, 2024, Chainwire

Chintai, the Layer-1 blockchain designed for institutional-grade tokenization of real-world assets (RWAs), proudly announces the launch of Kin Capital’s $100 million real estate debt fund. Beginning with an initial $5 million tranche, this fund marks a groundbreaking milestone in integrating traditional finance with blockchain technology.

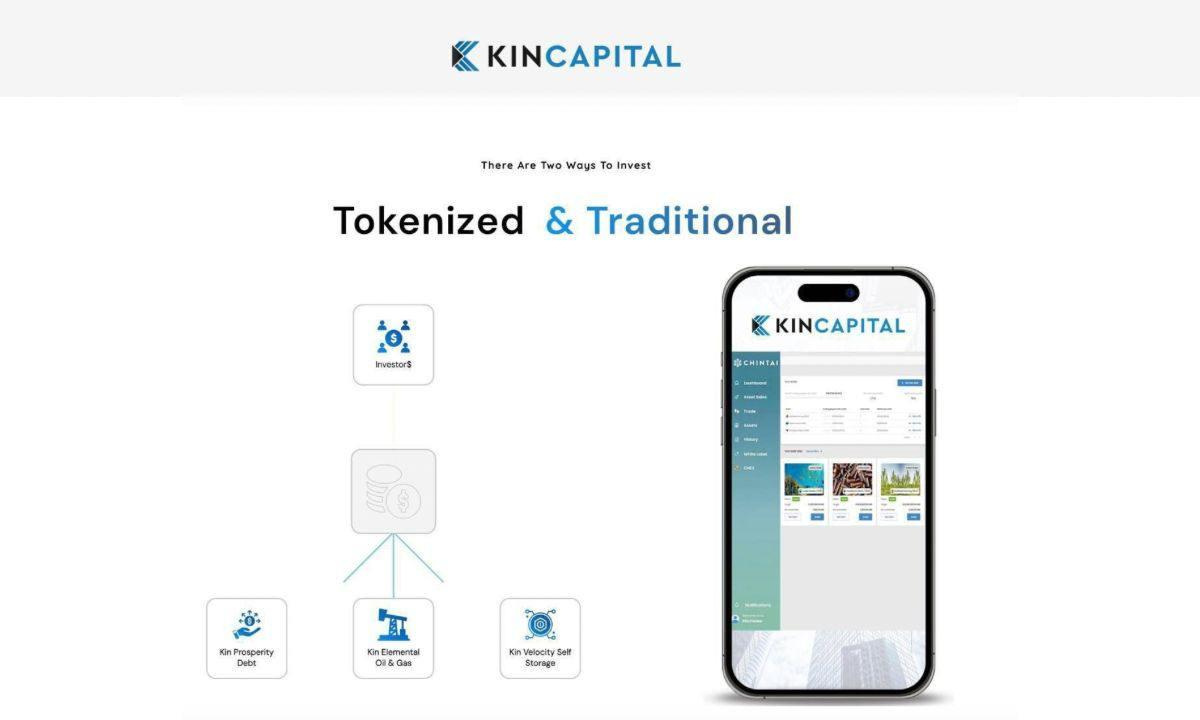

Kin Capital’s fund is available to accredited investors and offers access to real estate debt backed by commercial properties. By leveraging blockchain technology to enhance transparency, liquidity, and security, the fund aims to offer a modernized approach to real estate investment. The minimum investment is $50,000, with key features including:

- Potential for Consistent Returns: Investors have the potential to earn returns supported by commercial real estate, blending the stability of traditional assets with yields that are competitive with decentralized finance (DeFi) alternatives.

- Enhanced Liquidity Options: Kin Capital’s white-labeled marketplace harnesses the power of blockchain tokenization to unlock liquidity, enabling investors to trade or exit positions easily—unlike traditional real estate funds.

Adam Menconi, Principal of KIN Capital Group : Kin Capital Group is thrilled to partner with Chintai to harness the power of its customizable white-label platform. By providing investors and fundraisers with seamless access to a Web 3.0 experience, Chintai enables us to bring the future of investing to our clients. We’re excited to roll out our new debt fund, tokenizing real-world US-based 1st position performing Trust Deeds, and offer investors a more efficient, secure, and transparent way to invest in tangible assets.

Chintai’s cutting-edge blockchain, powered by the CHEX token, ensures that every tokenized asset meets strict regulatory standards, providing unmatched security and compliance in the evolving digital finance landscape.

David Packham, CEO Of Chintai : We are thrilled to partner with Kin Capital in launching this groundbreaking $100 million real estate debt fund. By leveraging Chintai’s cutting-edge blockchain technology, we can offer unprecedented transparency, liquidity, and security to traditional real estate investments. This collaboration not only bridges the gap between traditional finance and blockchain innovation but also provides accredited investors with unique opportunities to achieve stable and attractive returns in a rapidly evolving digital landscape

The initial $5 million tranche marks the beginning of Kin Capital’s broader $100 million fund. Additional commercial real estate offerings are planned for release through 2024 and into early 2025. As the fund grows, Chintai’s blockchain technology will continue to offer access to a secure and efficient investment platform.

Accredited investors can visit here to learn more and participate in Kin Capital’s real estate debt fund.

For media inquiries or to schedule an interview with CEO David Packham, please contact evan.shepard@chintai.io

About Kin Capital

Kin Capital is a leading investment firm specializing in innovative financial products that offer stable and attractive returns.

By leveraging cutting-edge technology and a deep understanding of market dynamics, Kin Capital provides unique investment opportunities that cater to modern investors’ needs. To learn more about Kin Capital, users can visit https://kincapgroup.com/tokenization.

About Chintai Network

Chintai aims to build a fair, transparent, inclusive financial system. Chintai provides financial companies and SMEs with blockchain infrastructure for the full trade life cycle of real-world digital assets. Using Chintai’s Blockchain-Platform-as-a-Service product suite, users have the tools to customize their digital asset product to meet their unique business objectives. Learn more by visiting Chintai’s website at https://chintai.io/.