NFTfi, leading lending and liquidity protocol for NFTs Raises $6 Million in Series A1

Cape Town, South Africa, March 11th, 2024, Chainwire

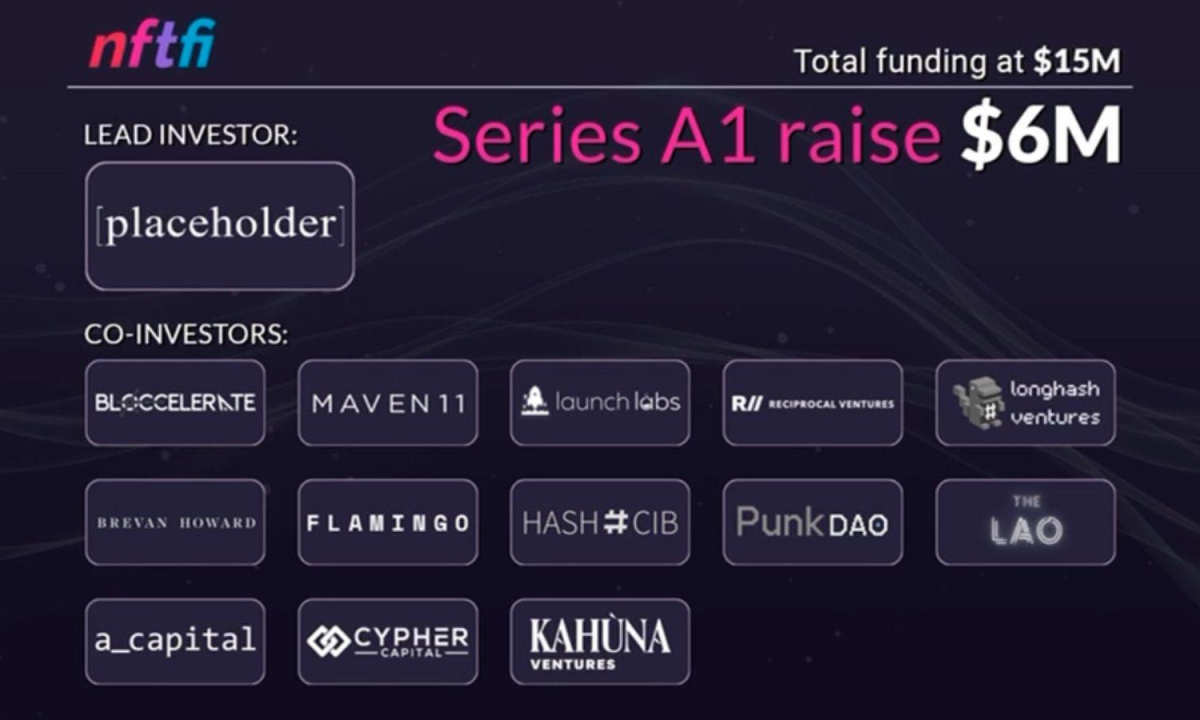

NFTfi, the leading lending and liquidity protocol for NFTs, has announced the successful completion of its Series A1 funding round with $6 million USD raised. Led by Placeholder VC, renowned investors in successful decentralized protocols and web3 services, this latest round of funding brings NFTfi’s total funding to $15 million USD.

Some notable co-investors include Maven 11, Launch Labs Inc, Kahuna Ventures, Brevan Howard, The LAO, Reciprocal, a_capital Ventures, Hash, Bloccelerate, Cypher Capital, Longhash Ventures, and prominent angels and DAOs like Punks DAO and Flamingo DAO.

The History of NFTfi

Launched in 2020, NFTfi is the pioneer of the NFT Finance space. On May 15, 2020, NFTfi was used to execute the first on-chain NFT loan and later set a record with a $1.42 million USD loan against Autoglyph #488 on October 21, marking the largest historical loan on a single NFT.

More recently, NFTfi has had a strong strategic push into RWAs (Real World Assets), partnering with Fabrica Land to enable users to unlock their first loans backed by tokenized real estate. The integration of Tokenized Luxury Watches into the platform is next.

NFTfi has also been a step ahead in leveraging NFTs for more advanced DeFi composability. By partnering with Sablier, Token Stream, and Sudoswap, for instance, the protocol now enables financial NFT-backed loans.

NFTfi’s user-centric approach has earned it a devoted following within the industry. With a total loan volume (TLV) surpassing $534 million USD, NFTfi has solidified its position as a leading dApp in NFT finance. In fact, lenders on NFTfi have earned over $15 million USD in interest to date, underscoring the platform’s value proposition.

In a short period of time, NFTfi has emerged as the go-to protocol for blue-chip NFTs, with top-tier collateral used on the platform and historical load total volume reflecting the platform’s dominance. Notable collaterals that are most prevalent on NFTfi include CryptoPunks, Bored Ape Yacht Club, Mutant Ape Yacht Club, Art Blocks, Autoglyphs, Doodles, Pudgy Penguins, Azuki, Clone X, Otherdeed for Otherside, and others.

Looking Ahead

With the total NFT market cap currently standing at around $10 billion USD and the total NFT lending market outstanding debt at $179 million USD, the team behind NFTfi views NFT finance as one of the most promising sectors for growth. As debt represents only 1.79% of the total market cap, NFTfi team is optimistic that there is still significant room for expansion, mirroring traditional markets where debt often accounts for at least 10% of the market cap.

Looking ahead, NFTfi’s evolution will unfold in three stages:

- Stage 1: NFTfi will enhance its dApp to support manual P2P loans further, a strategy that has already generated hundreds of millions in volume.

- Stage 2: NFTfi will expand the capabilities of its renowned SDK to foster new vertical integrations and boost liquidity on the platform.

- Stage 3: The fundraising efforts will bolster the creation of an open settlement layer for NFT finance, aimed at accommodating other protocols to use its tech stack and unleashing unlimited network effects.

About NFTfi

NFTfi is the most battle-tested lending and liquidity protocol for NFTs. NFTfi allows NFT holders to borrow ETH, USDC, or DAI from lenders by using their NFTs as collateral in a trustless peer-to-peer (P2P) fashion.

For more information, users can visit NFTfi and follow NFTfi on X/Twitter