Algebra DEX Engine Introduces ‘Integral’ & its Sushi Integration Proposal

Dubai, UAE, November 23rd, 2023, Chainwire

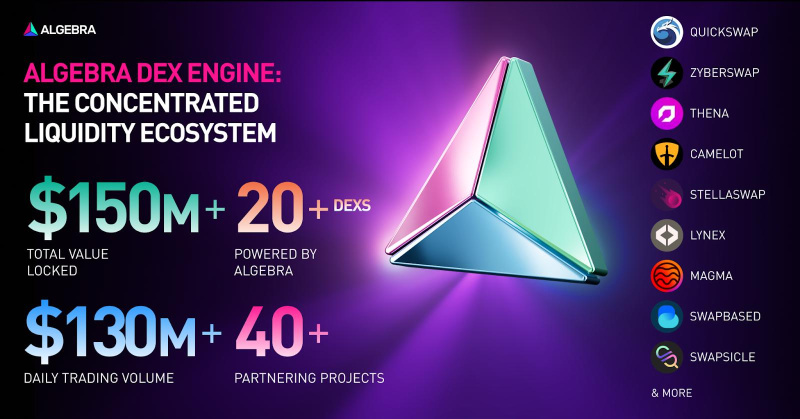

Algebra, once a multi-solution DEX, now known as the DEX Engine, retains and refines concentrated liquidity, enhancing functionality. With over 20 integrated decentralized exchanges, including THENA Fusion, Camelot V3, QuickSwap V3, and even more, Algebra boosts these DEXes’ competitiveness and provides users with advanced options through its seamlessly integrated codebase.

The introduction of ‘Integral’ Modular Architecture marks a significant step forward, enabling projects to rival Uniswap V4, improving gas cost efficiency, and plugging new functions to DEXes on air. The breakthrough tech was unveiled on October 17th through the Swapsicle DEX on the Mantle & Telos Blockchains, and is yet to be integrated into Sushi.

TL;DR

Algebra DEX Ecosystem Overview:

- Ultimate DEX solution operating as a B2B project on 20+ DEXes, providing concentrated liquidity solution with dynamic fees

- Over $150 million TVL across all decentralized exchanges, with daily trading volume of up to $212 million.

- Algebra secures its position in the top 10 most forked protocols by TVL on DefiLlama

- Over 50 protocols building on top of the Algebra solution

Integral Modular Architecture:

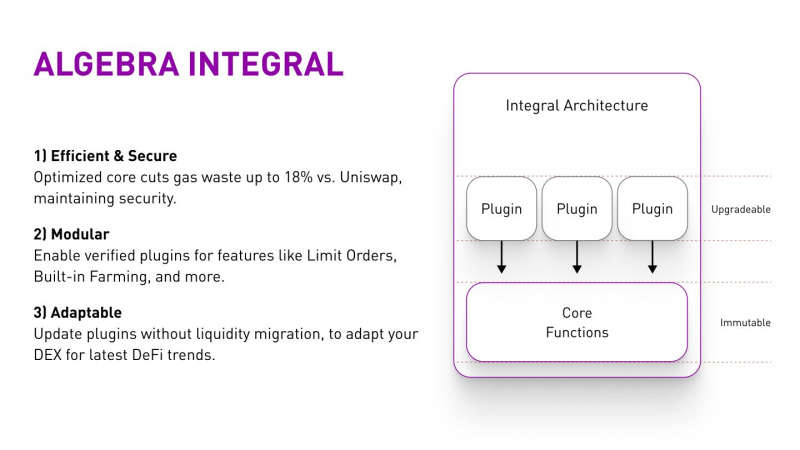

- Integral, a revolutionary V4 tech, features a modular architecture that allows a partnering DEX to compete with Uniswap V4

- Integration with Sushi proposes a next-gen DEX engine, enabling easy updates and plugin additions without disrupting DEX activities, all packed up with concentrated liquidity & other features.

- Integral offers advantages like enhanced gas efficiency, modularity, and diverse revenue streams, saving up to 22% in gas costs.

- Partnership aims for increased TVL, trading volume, and overall efficiency on the Sushi platform.

- Key part of the collaboration is the Plugin Marketplace development, fostering a hub for DeFi innovation.

Modern DEX Hassles

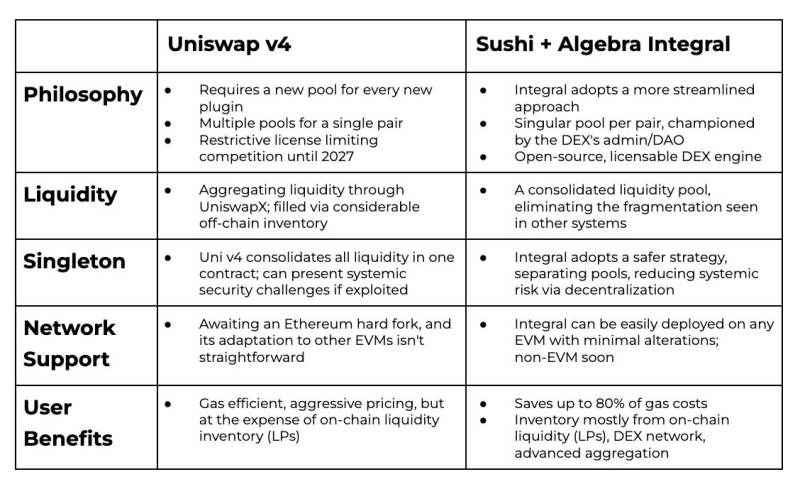

The crypto community is buzzing about Uniswap V3’s license expiry and the potential of Uniswap V4. Launched in March 2021, UniV3 rose to the top in the DEX market with its concentrated liquidity innovation. Now open-sourced, UniV3 allows decentralized exchanges to adopt this concept. However, the abundance of AMMs leads to liquidity fragmentation and market inefficiency.

Last but not least: traditional AMMs pose challenges for DEX protocols in updating infrastructure due to the necessity for liquidity migration with each new version, complicating the implementation of new ideas.

On the flip side, UniV4’s announcement brings flexibility and revolutionary changes, opening doors for indie developers. Questions arise about the adequacy of old AMM models like V3 against new competitors, the global market impact, and how UniV4 will reshape the DEX landscape.

Algebra ‘Integral,’ offering an innovative modular architecture for a cost-effective, customizable, and secure DEX, inspired by the V4 concept. Algebra Integral addresses these challenges with customizable plugins managed by the DAO, providing control over configuration and connectivity.

What’s Algebra DEX Ecosystem?

Algebra, an ultimate DEX solution, works as a B2B project, already empowering over 20 DEXes, including the likes of THENA, Camelot, QuickSwap, Swapsicle, StellaSwap, and more, across 20+ chains, with over 50 protocols building on top of Algebra solution.

Algebra’s innovative features and partnerships have positioned it as a top-tier concentrated liquidity tech provider, gaining popularity and earning a spot among the top 10 most forked protocols by TVL.

For now, its TVL across all Algebra-built decentralized exchanges totals over $150 million, while its trading volume has recently surpassed the mark of $198 million.

Part of the trading fees goes to the Algebra development team, and part of it is used for weekly $ALGB buybacks & burns.

Algebra’s concentrated liquidity solution offers capital-efficient trading with dynamic, or volatility-based, fees, allowing LPs to specify price ranges for enhanced efficiency and reduced impermanent loss.

Unlike Uniswap V3, Algebra’s dynamic fee model calculates fees based on risk, volatility, and pool volume, providing higher returns for LPs.

Algebra also offers the following features within its ready-to-integrate codebase: Built-in on-chain Farming, Customizable Tickspacing, Rebase Tokens’ Support, Limit Orders and a bunch of other innovations.

Algebra ‘Integral’: The Revolutionary V4 Tech Proposed to Sushi

Earlier this Fall, Algebra has introduced its latest update, high inspired by Uniswap V4. Integral, now available on Mantle & Telos via Swapsicle DEX, is a next-gen concentrated liquidity engine with a modular architecture, featuring an immutable core codebase & highly customizable plugins. This integration allows the addition of plugins on top of liquidity pools, as well as easy platform updates without crucial DEX activities disrupting the need for liquidity migration. It marks a significant leap forward in DeFi, providing a more agile and efficient framework for innovation.

Together with Sushi, Algebra team has introduced an integration proposal to deploy the brand-new V4 implementation into Sushi.

The Sushi and Algebra integration goes beyond just a timing advantage:

The implementation of Algebra Integral tech offers Sushi numerous advantages. The final goal of this integration is a significant increase in TVL, trading volume, and overall efficiency, which the platform’s revenue growth will follow:

- Enhanced Gas Efficiency: Algebra’s Integral is designed to significantly reduce gas costs, saving 7-22% compared to current systems.

- Innovative Modularity and Customizability: The system allows Sushi to adapt swiftly to market trends and technological advancements.

- Diverse Revenue Streams: Custom plugins open up new avenues for revenue generation and stakeholder engagement.

- Fostering a Hub for DeFi Innovation

A key part of this partnership is the Plugin Marketplace development on the Sushi platform, envisioned as a dynamic hub for innovation.

The proposal is now on Discourse for discussion and voting.

About Algebra Labs

Algebra is a dedicated team specializing in research and development within the AMM space. In 2021, as a DEX solutions team, they made a significant impact by launching the first decentralized exchange with improved V3 tech.

Algebra has established partnerships with over 25 decentralized exchanges, boosting their capital efficiency. These collaborations have resulted in a total TVL of up to $162 million, with a Daily Trading Volume of up to $200M, and they are continuously expanding their network of partners.