Contango brings cPerps to Optimism

London, UK, October 13th, 2023, Chainwire

Contango, a unique decentralized market that builds perps on top of money markets, has expanded to Optimism today, after a successful launch on Arbitrum last week.

Its unique perpetual instruments are called cPerps (Contango perps) and are built without an order book or liquidity pools.

At a high level, long and short positions are synthesized by creating a leveraged exposure on spot and money markets. More precisely, Contango builds perps by automating a looping strategy. Looping is the DeFi-native way of leveraging on-chain and became popular in 2017 when users started borrowing and lending recursively on MakerDAO and later on Compound to increase their exposure to a certain asset.

Contango automates looping via flash loans. As an example, when a trader opens a long ETH/DAI position with DAI as margin, the protocol gets the remaining DAI from a flash loan, swaps all DAI for ETH on the spot market, and lends ETH on a money market to repay the flash loan (a detailed explanation of this architecture is available here).

Currently, Contango employs Aave as the underlying money market, on both Optimism and Arbitrum.

“We decided to integrate Aave first – explains Kamel Aouane, co-founder of Contango – because we can tap immediately into its $4.6B liquidity and allow users users to trade with size from day one”.

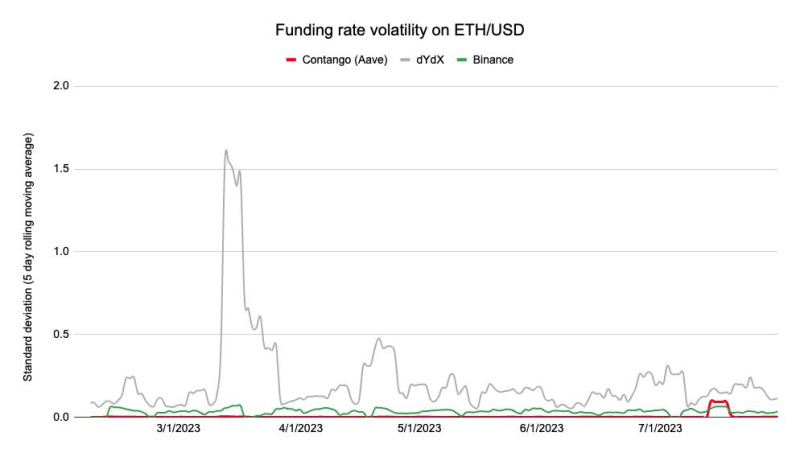

Aave has another key benefit for Contango: cPerps funding rates are determined by Aave’s lending and borrowing rates, and these are notoriously less volatile than funding fees of derivative exchanges. An internal study by the Contango team (see below) confirms that over the past 8 months these rates have been less volatile than Binance, the largest centralized exchange, and dYdX, the leading decentralized derivatives protocol (source).

“We’re eager to launch on Optimism – continues Aouane – as this officially makes Contango a multi-chain protocol. Because of Optimism’s cheap transactions, we can also allow fee-sensitive users to trade perps on existing liquidity without fragmenting it even further.”

Aouane emphasized the scalability of the design behind Contango: “We can expand both horizontally, by launching on more chains, and vertically, by integrating more markets within the same chain. The ultimate goal is to aggregate as many liquidity sources as possible, and unlock a DeFi derivative market that is worth $13B”.

Beside Aave, the team is planning integrations with Compound, Spark, MakerDAO, and Morpho Blue. “The integration with Morpho Blue is particularly interesting – says Aouane – as their new design with custom loan-to-values could allow for higher leverage on Contango”.

Traders can already try cPerps on Optimism at: https://app.contango.xyz/

About Contango

Contango builds perps through looping on money markets. Deep liquidity is sourced on money markets, where interest rates produce less volatile funding rates. An intuitive trading interface welcomes advanced traders ready to trade with size, seasoned loopers looking for better monitoring tools, and degens eager to farm rewards on money markets.