YC-backed PrimeVault Builds the Future of Institutional DeFi

San Francisco, California, September 4th, 2023, Chainwire

PrimeVault, a startup backed by Y Combinator, Arrington Capital, HashKey, Cogitent Ventures and other Web3 institutional and ecosystem funds, is coming out of stealth with its suite of next-generation products that give institutions and businesses greater advantage and sophistication in working with digital assets.

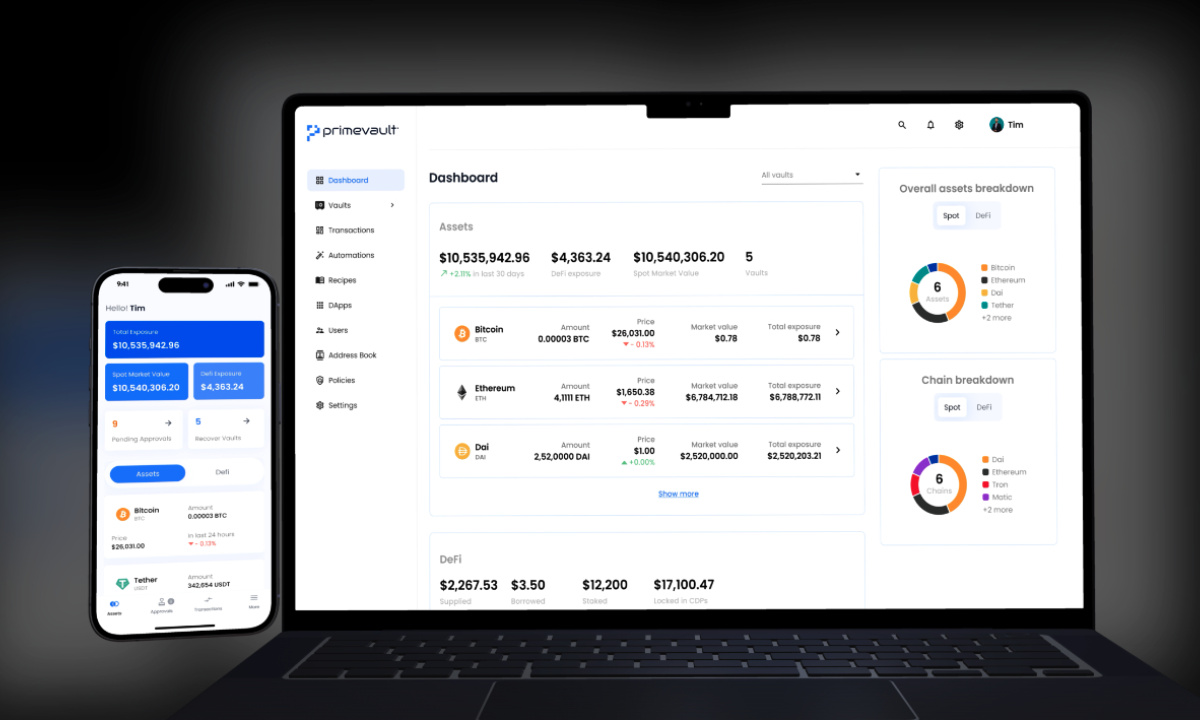

PrimeVault’s platform comprises a novel approach to institutional-grade self-custody, deep and direct access to cross-CeDeFi markets, secure and trustless DeFi automations, and native token issuance and vesting/distribution empowering organisations with the most advanced suite of core crypto capabilities to leverage digital assets under one roof.

At its core, PrimeVault leverages advanced cryptography to securely mesh smart contracts and Multi-party Computation (MPC) technology that simultaneously enhances the security, trustlessness, and efficiency of the state-of-the-art in institutional custody technology while allowing for powerful capabilities such as on-chain and cross-chain DeFi automations at enterprise scale.

Beyond traditional approaches to enterprise custody

As DeFi matures and offers lucrative trading opportunities, institutional investors who are interested in exploring this new frontier are often held back by the lack of secure, compliant and efficient on-chain infrastructure. PrimeVault is dedicated to building just that.

“As crypto resolves its scaling and privacy challenges, powerful enterprise-grade crypto wallet infrastructure that seamlessly interoperates with on-chain markets and DeFi will become important with institutions, businesses and governments and that is exactly what we’re building, ” says Prashant Upadhyay, PrimeVault’s co-founder and CEO.

“Traditional custody solutions are designed for long-term holding of crypto assets in safe vaults. These frequently lack the ability for investors to leverage their crypto assets productively such as via blockchain staking or enterprise-level DeFi interoperability. Even when traditional custody companies do offer these services (as they increasingly promise to do), these are merely add-ons to their core cold storage offering and inherently rely on intensive and error-prone manual operations to move assets that quickly become unviable at scale. By contrast, PrimeVault is built from the ground up to support crypto operations at scale and uniquely offers secure trustless on-chain automations, allowing institutions to be highly operationally efficient.” says Upadhyay.

The other main issue is the centralization of existing infrastructure that leaves users vulnerable to counterparty risks. Users are forced to place an uncomfortable degree of trust in the internal operations and processes of these companies, a lot of which they’re clueless about.

All these factors, combined with confusing user experience (UX), have made it hard for enterprises to confidently participate in DeFi. But the potential of institutional-grade DeFi interactions remains – and PrimeVault aims to accelerate institutions’ participation in DeFi.

Redefining institutional crypto custody and trading

PrimeVault is building a comprehensive security and CeDeFi trading platform that lets institutional users collectively manage assets by directly controlling their private keys, thereby eliminating custody counterparty risks. Admins can configure rules to access shared wallets, exchange accounts, trading platforms and DeFi protocols on an institutional scale, all while retaining total control of their assets.

“One of the fundamental ways crypto differs from other asset classes is the possibility of secure, efficient and expressive forms of self-custody at any scale. Contrast this to traditional asset classes like securities, government bonds, fiat currencies or physical commodities like gold – where a regulated custody function becomes necessary to operate efficient markets. As crypto resolves its scaling and privacy challenges, powerful self custody infrastructure that seamlessly interoperates with on-chain markets and DeFi will become important with institutions, businesses and governments and that is exactly what we’re building.” says Upadhyay.

PrimeVault’s secure stack combines smart contract programmability and immutability with institutional-grade security to provide enterprises with a private, secure, and scalable way to manage digital assets and access DeFi.

At the core of the platform is a novel implementation of decentralized MPC. It uses a trustless smart contract co-signer to eliminate centralization, thereby mitigating counterparty risks typical of traditional custody solutions.

With the blockchain as one of the MPC signers, PrimeVault unlocks the potential of on-chain automation in DeFi by offering trust-minimized generalized wallet automation. Users can set up automation-enabled wallets and set conditions for any on-chain transaction knowing the smart contract will execute autonomously once it verifies that the conditions have been met.

Security is ensured by a multi-layer security architecture that includes a multi-enclave design for failsafe hardware-level isolation of sensitive cryptographic operations. Users can also configure bespoke multifactor security to manage their risk exposure. PrimeVault also proactively scans risk signals and alerts users with recommended as well as automated actions.

All these features are accessible via an intuitive UI akin to a Web2 experience, with enterprise-level user configurability and access controls.

About PrimeVault

Backed by Y Combinator, PrimeVault is building the next generation of Web3 security and on-chain trading infrastructure for institutional and enterprise use. The company has created an all-in-one asset management platform for managing tokens and digital assets across different chains.

PrimeVault has the vision to accelerate the migration of core financial services on-chain and is on a mission to make direct institutional participation in on-chain activities easy and secure.

PrimeVault was founded by Tanmay Chaudhari, Vivek Kumar, and Prashant Upadhyay. The three met at Rippling, a Silicon Valley-based B2B HR, Finance and IT automation company, where they were early product and engineering leaders on Rippling’s Finance and Compliance products and oversaw the platform’s growth as Rippling scaled to a $11bn juggernaut. The founding team brings together a unique mix of deep experience in building enterprise-grade financial products coupled with industry-leading expertise in deep-tech, cryptography and cybersecurity that make it uniquely positioned to serve the enterprise and institutional crypto market.

For more information: Twitter | LinkedIn | Primevault | Y Combinator