Huobi is dedicated to User Asset Security and Releases a Firm Response towards Baseless Claims of “Asset Decline”

Singapore, Singapore, July 13th, 2023, Chainwire

Recently, ungrounded allegations are spreading on social media regarding a supposed “decline in assets” at global major exchange Huobi. To prevent panic among users, Huobi has released a necessary response based on data and facts.

On July 1, the crypto giant published its Merkle Tree-based proof of reserves for July, confirming that the total assets the platform holds in custody for users exceed $3 billion.

Misleading claims stem from outdated data on third-party platform

Since July 6, some social media influencers have posted unsubstantiated claims about “asset decline” at Huobi. In response, the exchange made the following statements:

Those influencers’ claims are based on asset data provided by Glassnode. However, according to professional analysis, the data obtained by Glassnode is inaccurate, with evident gaps and omissions in addresses. This is due to the following reasons:

1. Huobi’s major cold and hot wallet addresses used for asset storage have been changed since the completion of a share transfer on October 8, 2022.

2. Huobi’s assets are distributed across multiple chains, including 400 million USDT on TRON, 6,500 TRC20 BTC, and a portion of ETH used as collateral for ETH validators. However, Glassnode failed to promptly update relevant data based on this information and changes.

Huobi has established contact with Glassnode and requested the necessary data updates.

Huobi has voluntarily disclosed its major addresses since the end of November 2022. Following the collaboration with Nansen, a blockchain analytics platform, Huobi has provided Nansen with the relevant addresses. Furthermore, all address changes whether resulting from the replacement of major shareholders or due to system upgrades have been synchronized with Nansen.

The Huobi assets details displayed on Nansen can be found publicly at:

https://portfolio.nansen.ai/dashboard/huobi

In reality, this steep decline is not caused by any changes in the platform security or user trust. Instead, it can be attributed to Huobi’s withdrawal from certain markets. Therefore, it is important to understand that both the fluctuations in user base and assets are within the realm of normalcy.

Since the beginning of 2023, Huobi has maintained a stable and upward momentum, without experiencing any significant changes.

Pursuit of asset transparency by upholding highest industry standards in safeguarding user assets

As a prominent digital asset exchange, Huobi prioritizes its users and considers the protection of user funds as its primary responsibility. Huobi’s on-chain wallet assets are publicly transparent, and users can verify at any time that their funds have a 1:1 backing of real assets.

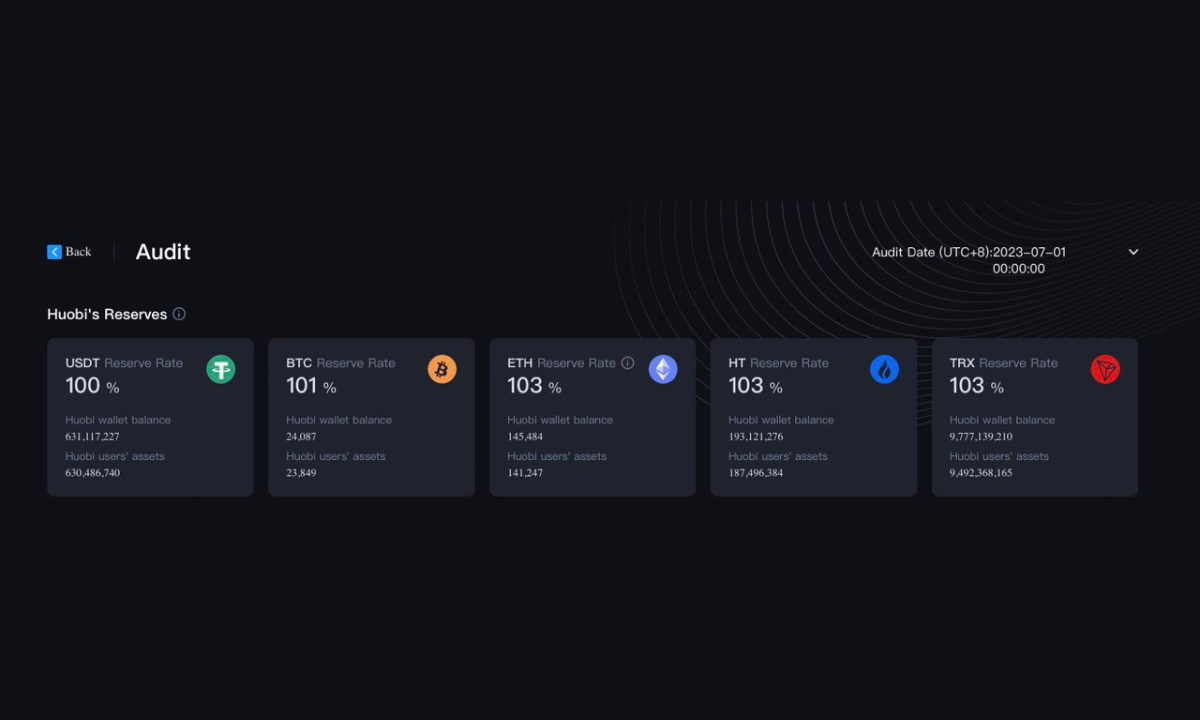

Starting in 2023, Huobi updates the Merkle Tree-based proof of reserves every month and publishes it to the public. Currently, Huobi’s on-chain assets ensure permanent 100% redeemability for user assets. Users can view Huobi reserves of BTC, ETH, BETH, TRX, USDT, and HT in detail on the asset audit page of Huobi’s official website, including reserve ratio, Huobi wallet’s assets, and Huobi’s user assets.

The specific asset proof of reserves can be viewed at: https://www.huobi.com/en-us/finance/merkle/.

The assets applicable for Proof of Reserves are BTC, ETH, BETH, USDT, TRX, and HT.

Huobi’s current reserve ratios are as follows:

USDT: 100%

BTC: 101%

ETH+BETH: 103%

HT: 103%

TRX: 103%

In the future, Huobi will continue to publish Merkle Tree PoR to the public and put users first with professional and reliable digital asset trading services in line with high industry standards.

About Huobi

Founded in 2013, Huobi has evolved from a crypto exchange into a comprehensive ecosystem of blockchain businesses that span digital asset trading, financial derivatives, wallets, research, investment, incubation and other areas. Huobi serves millions of users worldwide, with a business presence covering over 160 countries and regions across five continents. Its three development strategies – “global development, technology drives development, and technology for good” underpin its commitment to providing comprehensive services and values to global cryptocurrency enthusiasts.