KyberSwap announces first ever $ARB token liquidity pools, liquidity mining and trading campaigns on Arbitrum

Ho Chi Minh City, Vietnam, 22nd March, 2023, Chainwire

Since launching in 2021, Arbitrum has emerged as one of the most promising Layer 2 solutions, with its ability to scale Ethereum and enable faster and cheaper transactions.

On March 16, Ethereum Layer 2 scaling solution Arbitrum announced plans to distribute a new governance token, $ARB, to its eligible Arbitrum ecosystem users as part of its transition, noting that the project is “leading the way as the first L2 to launch self-executing governance.”

This airdrop, estimated to go live on 23 March, is set to be one of the biggest airdrop in crypto history.

KyberSwap was among the protocols whose users bridged to Arbitrum and conducted swaps on the platform, thereby becoming eligible for the $ARB Airdrop.

KyberSwap, a leading decentralized exchange (DEX) aggregator and liquidity platform, will launch the first-ever $ARB token liquidity pools, liquidity mining, and trading campaigns on the Arbitrum Chain. These moves mark significant steps forward for KyberSwap, as it will assist to catalyse significant liquidity inflows, thus increasing TVL and provide more earning opportunities in the rapidly growing Arbitrum ecosystem.

With the launch of the $ARB liquidity pools, KyberSwap users will now have access to more trading pairs and liquidity options. Liquidity providers will also have more opportunities to earn fees and rewards by adding liquidity to the $ARB pools and participating in liquidity mining programs by KyberSwap.

The following ARB pools will be eligible for liquidity mining rewards:

Token Pairs

- ARB-ETH (2%)

- Apr ARB-ETH (5%)

- ARB-USDT (2%)

- ARB-USDT (2%)

- ARB-KNC (5%)

An estimated total of 70,000 KNC has been allocated as reward incentives.

*Incentives may continue after the designation duration is over; to be confirmed at a later date.

Greater Flexibility with new Fee Tiers

With these highly anticipated yield farms, KyberSwap is introducing new 2% and 5% fee tiers, which exceeds their current highest offering of 1%. These new fee tiers provide opportunities for $ARB farmers to benefit from the anticipated high volatility and trading volume, during the price discovery phase after the airdrop. These pools offer superior returns in addition to the farming rewards, and as a liquidity protocol that has been seamlessly integrated by multiple DEXs and aggregators, KyberSwap is well poised to serve the trading needs of the entire chain not found with other competitors.

“We are excited to launch the first ever $ARB liquidity mining pools,” said Victor Tran, CEO and Co-founder of KyberSwap. “These farms will mark the beginning of an extensive Arbitrum-centered campaign KyberSwap has planned, and we will announce more rewards and activities soon for both LPs and traders. Additionally, traders can set their prices to purchase or sell $ARB with our limit order function and swap at the optimised rates with our aggregator.”

Other Arbitrum Yield Farms on KyberSwap

Apart from the upcoming ARB farms, there are other ongoing Arbitrum-based yield farms on kyberswap.com:

Depending on the success of $ARB trading volume, the KyberSwap team is planning additional rewards post-launch for traders and liquidity providers which may include $ARB and $KNC airdrops, and commemorative NFT rewards.

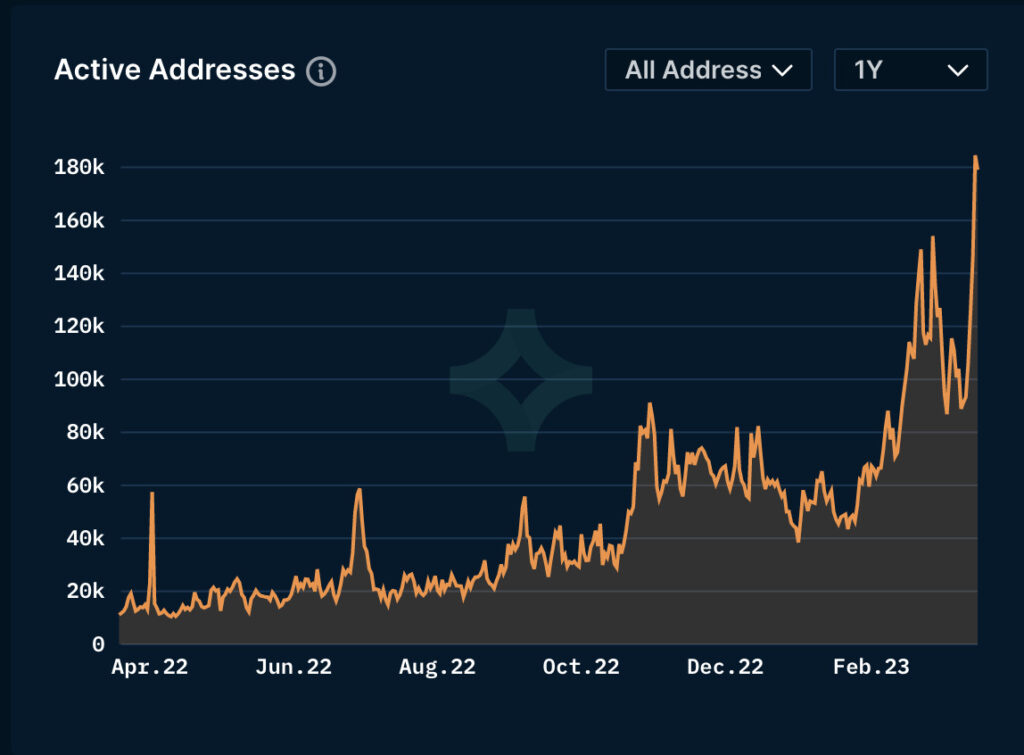

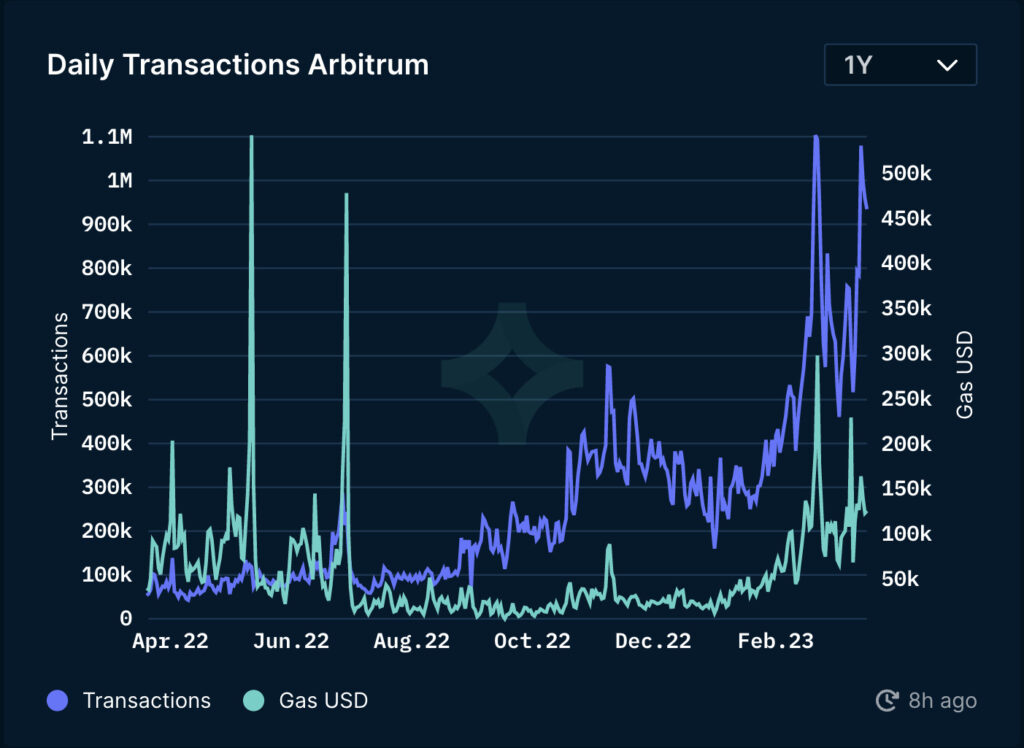

According to Nansen, Arbitrum was one of the fastest-growing blockchain in 2022 with more than $1.1 billion locked in its ecosystem and a rapid increase in transactional volume, this layer-two scaling solution gained massive traction during the year.

*Arbitrum Active Addresses/Transactions

*Arbitrum Active Addresses/Transactions

The $ARB token liquidity pools, liquidity mining, and trading campaigns are set to go live on KyberSwap soon, with further details and instructions to be provided on KyberSwap’s Twitter and on kyberswap.com.

About KyberSwap

Kyber Network is building a world to make DeFi accessible, safe and rewarding for users. Their flagship product, KyberSwap, is a next-gen DEX aggregator providing optimised rates for traders and returns for liquidity providers in DeFi.

For liquidity providers, KyberSwap has a suite of capital-efficient protocols designed to optimize rewards. KyberSwap Classic’s protocol is DeFi’s first market maker protocol that dynamically adjusts LP fees based on market conditions, while KyberSwap Elastic is a tick-based AMM with concentrated liquidity, customizable fee tiers, reinvestment curve and other advanced features specially designed to give LPs the flexibility and tools to take your earning strategy to the next level without compromising on security.

KyberSwap powers 100+ integrated projects and has facilitated over US$15 billion worth of transactions for thousands of users since its inception.

Currently deployed on 13 chains, including Ethereum, Polygon, BNB, Avalanche, Fantom, Cronos, Arbitrum, BitTorrent, Velas, Aurora, Oasis, Optimism and Solana, KyberSwap aggregates liquidity from over 80 DEXs to give users the best rates possible for their swaps.

*Arbitrum Active Addresses/Transactions

*Arbitrum Active Addresses/Transactions