Outlier Ventures Welcomes Seven Teams to Real World Assets Base Camp

London, United Kingdom, November 26th, 2024, Chainwire

- Outlier Ventures launches the second RWA Base Camp Accelerator program to support early-stage founders. The RWA Base Camp will double down on startups building infrastructure, applications, and products that will fuel the mainstream adoption of tokenized real-world assets (RWA) across industries.

- The RWA Base Camp, in collaboration with Singularity Finance, will support startups that are building the required infrastructure, applications, and products to fuel the mainstream adoption of tokenized RWA across industries.

- The 12-week virtual accelerator program will include workshops with subject matter experts from Outlier Ventures and Singularity Finance and mentorship from industry experts.

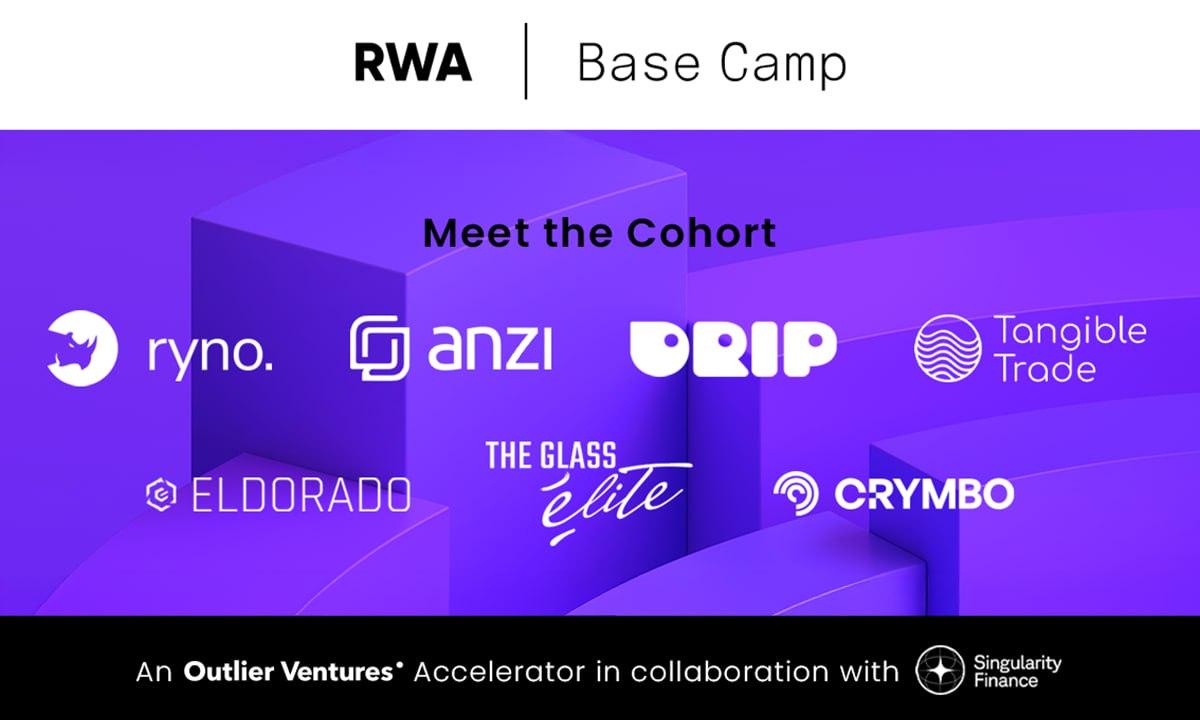

Outlier Ventures is pleased to announce the seven teams participating in the RWA Base Camp accelerator program. Over twelve weeks, the cohort will receive hands-on support from Outlier Ventures’ top-tier experts across various areas, including marketing, advisory, token design, engineering, investment, fundraising, and more, along with guidance and investment from Venture Partner, Singularity Finance.

As major banking players make strides into the RWA blockchain space, tokenizing RWAs continues to explore novel methods to bridge the gap between crypto and traditional financial markets. This innovation is set to transform industries as blockchain technology becomes increasingly integrated into society over the next decade. A recent study projects the RWA tokenization market will grow from $118 billion to $10 trillion by 2030. In 2023, we articulated our vision for RWA in our thesis “Tokenization Of RWAs: Beyond The Hype”, followed by a hugely successful first cohort. Outlier Ventures remains bullish on building infrastructure, applications, and products to fuel the mainstream adoption of tokenized RWA across industries.

Katie Lundie, RWA Base Camp Accelerator Lead, Outlier Ventures, said “We’re excited to announce the launch of our second RWA Base Camp, aimed at accelerating the adoption of tokenized real-world assets across industries. In partnership with Singularity Finance, this program offers expert support in areas like legal frameworks, token design, community building, tokenomics, fundraising, pitch decks, and mentorship. The selected teams were chosen with founders representing some of the most promising early-stage startups pioneering the next generation of RWA solutions, including tokenized commodities, NFTs, digital identities, and more.”

Cloris Chen, CEO, Singularity Finance, said: “We are excited to support the Real World Assets Base Camp with Outlier Ventures and guide the founders through Outlier Ventures’ second accelerator program. As real-world assets continue to gain momentum and recognition within both the Web3 startup ecosystem and mainstream markets, we are eager to back the talented founders who have joined this program.”

Mario Casiraghi, Co-Founder of Singularity Finance, stated: “Our partnership with Outlier Ventures for the RWA Base Camp is a testament to our commitment to advancing the tokenisation of real-world assets. By supporting these talented founders, we aim to drive meaningful innovation at the intersection of blockchain, AI, and traditional finance, paving the way for the widespread adoption of tokenised assets across industries.”

Meet the cohort

ryno, United States of America

Borderless finance for emerging markets

ryno is a global technology company delivering frictionless, transparent and cost-efficient cross border financial solutions for enterprises in emerging markets. With the explosive growth of emerging markets economies, enterprises are demanding better access to global capital markets and inclusive financial services. ryno, founded by a team with over 30 years of global experience across financial services, payments and blockchain technology, is passionate about providing the innovation to access equitable global financial markets services.

Anzi Finance, Colombia

Tokenized credit default guarantees for SMB lenders.

Anzi mitigates lender risk through tokenized credit default guarantees and enhances credit access for small- to medium-sized businesses (SMBs). If an SMB defaults, Anzi compensates lenders with a portion of the principal, ensuring financial reliability. By automating guarantee payment execution, Anzi minimizes debt losses while safeguarding portfolio metrics and improving cash flow for lenders. Its blockchain-powered API and web app provide a secure, fast, and cross-border solution with instant, automated guarantee payments, making it easy to integrate and use.

Drip Rewards Inc, United States of America

Seamlessly mass-distribute digital collectibles in-person through inaudible sound waves

Used by over a thousand communities to engage over 2.6 million fans, Drip gamifies your online community into something worth coming back to. Through engagement, our platform transforms members into passionate superfans with custom rewards, social gaming, and an expanding app marketplace. The latest addition to our app store is Drip Drop, which enables seamless distribution of digital collectibles via sound waves at live events.

Tangible Trade, United States of America

First Synthetic Perpetual Swaps on any RWA

Tangible Trade enables synthetic trading of diverse financial assets through perpetual swaps, offering a cost-effective, highly liquid solution that grants access to virtually any asset class. With low fees, high liquidity, and accessibility, the platform empowers traders to operate efficiently in a decentralized environment.

Eldorado, UAE (Global, remote)

RWA Incubator and DeFi platform for Energy, Commodities & Infrastructure

Eldorado is transforming access to industries like mining, energy, and infrastructure by offering tokenized, compliant real-world assets (RWAs) through its platform. By leveraging blockchain technology, the platform enables broader participation and liquidity, providing retail investors with access to previously unavailable investment opportunities. Focused on regulatory compliance and user experience, Eldorado’s multi-phase strategy aims to democratize asset ownership and drive financial inclusion in traditionally institutional sectors such as mining, energy, and infrastructure.

The Glass Élite, Italy

A B2B platform leveraging NFTs for wine industry operators, investors, and collectors to securely buy and sell wine, streamline transactions, improve transparency, and unlock capital.

The Glass Élite project is a B2B digital platform that enables wine industry operators, professional investors, and collectors to securely buy and sell wine using blockchain technology. The platform leverages NFTs, blockchain, and RWA to streamline transactions, enhance transparency, and unlock capital for both producers and buyers.

Crymbo, Tel-Aviv

Decentralised compliance oracle for crypto transactions.

Crymbo bridges on-chain and off-chain data through a decentralized oracle, enabling real-time validation, secure identity management, and privacy-preserving compliance. Our interoperable platform is focused on unifying TradFi, CeFi, and DeFi into a seamless, cost-effective, and compliant ecosystem.

The RWA Base Camp program forms part of Outlier Ventures’ Base Camp accelerator programs that focus on supporting founders globally across high-growth regions, helping them to accelerate their product market fit. For more information, go here: https://outlierventures.io/base-camp/

About Outlier Ventures

Founded in 2014, Outlier Ventures is a global leading Web3 accelerator with a renowned reputation as the go-to authority for Web3 founders, investors and partners. With a portfolio of over 300 startups from every region of the world across its accelerator program Base Camp and token launch advisory Ascent, Outlier Ventures has helped raise over $350m in seed funding across its various accelerator programs. Outlier Ventures’ portfolio includes leading Web3 companies including Morgan Creek Digital’s portfolio company Swipelux, along with Biconomy, Boson Protocol, Brave, Cheqd, Cudos, DIA Data, Fetch.ai, IOTA, Ocean Protocol, Root Network and XAI.

Outlier Ventures partners with global industry protocol leaders, including Polygon and Wormhole, Aptos, Filecoin/IPFS, Hedera, NEAR, Polkadot, along with leading global brands to design bespoke programs by its team of experts that help refine business strategy, product-market fit, community growth, token design and governance as well as investor and mentor networks.

About Singularity Finance

Singularity Finance is the first AI-centric EVM-compatible L2 blockchain bringing the AI economy on-chain. It offers a fully compliant RWA tokenisation framework to tokenise and monetise the AI value chain in its entirety.

Stemming from the SingularityNET ecosystem and closely tied to the Artificial Superintelligence Alliance, Singularity Finance is poised to become the financial chain for everything AI.