Yala completes Seed Round co-led by Polychain Capital and Ethereal Ventures

Singapore, Singapore, October 10th, 2024, Chainwire

Leading industry investors join forces to support Yala’s vision of a connected multi-chain ecosystem with Bitcoin.

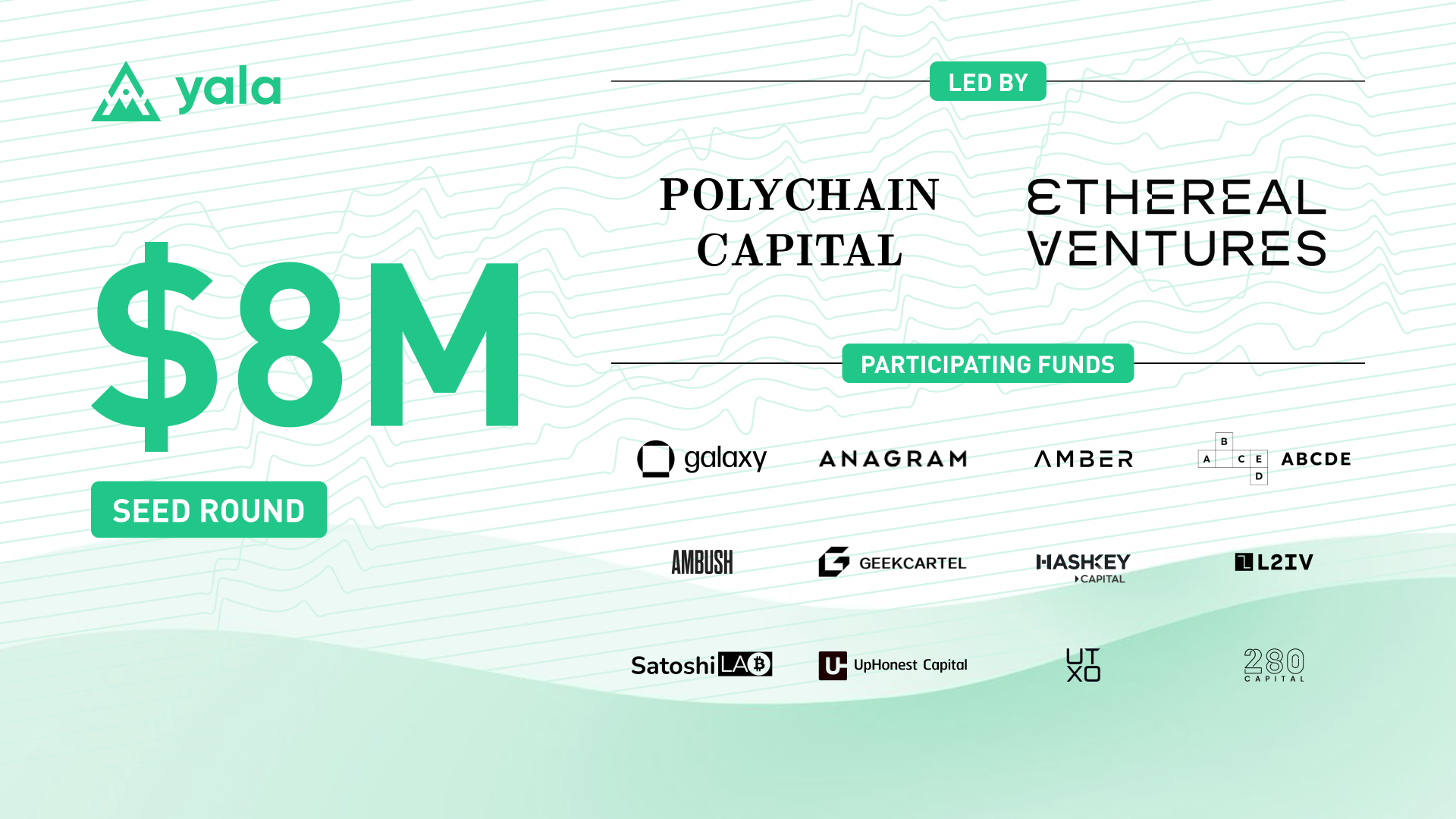

Yala, a liquidity protocol and stablecoin issuer for Bitcoin, has announced the successful completion of its 3x oversubscribed seed funding round. The round was co-led by Polychain Capital and Ethereal Ventures, with participation from prominent investors, including Galaxy Vision Hill, Anagram, Amber Group, ABCDE, Ambush Capital, GeekCartel, HashKey Capital, L2 Iterative Ventures (L2IV), SatoshiLab, UpHonest Capital, UTXO Management, and 280 Capital.

Yala’s team raised an $8 million seed round at an undisclosed valuation, funding the expansion of its engineering, growth, and security teams ahead of its mainnet launch. This follows over 2,000 BTC in committed deposits from investors.

Yala’s mission is to unlock Bitcoin liquidity through a protocol that combines stablecoin issuance with multi-chain ecosystems. Its modular architecture supports cross-chain deployments across EVM-compatible platforms like Ethereum and non-EVM systems like Solana, enhancing Bitcoin composability and driving a connected Bitcoin DeFi ecosystem.

Key Investors Highlight Support

“Our strategy is to invest in and support founders in building an ecosystem driven by strong synergies. Through its stablecoin, Yala will bridge the gaps, enabling our Bitcoin ecosystem to thrive with robust liquidity”, said the Polychain Capital Team.

“Yala’s approach addresses the current liquidity gap in the Bitcoin ecosystem. Their first-mover advantage, paired with the excellent execution speed of the team, will unlock new opportunities in BTC-related DeFi innovation. EV is thrilled to be supporting their journey,” added Min Teo, Managing Partner & Co-founder at Ethereal Ventures.

Yala’s Vision

Yala is building a modular infrastructure to deploy cross-chain modules, enhancing Bitcoin composability across ecosystems. The key components of the Yala protocol are:

- Overcollateralized Stablecoin Protocol: A Bitcoin-backed stablecoin ensuring security and stability.

- MetaMint: Enables minting stablecoins directly from the Bitcoin mainnet on the destination chain.

- Insurance Derivatives Service: Provides comprehensive insurance solutions within the DeFi ecosystem.

Yala’s multi-token system aims to boost Bitcoin cross-chain liquidity, featuring $YU (Bitcoin-backed stablecoin) and $YALA (the governance token of the Yala ecosystem). $YU allows Bitcoin holders to potentially earn yields across various cross-chain DeFi protocols while preserving the security and stability of the Bitcoin network.

“Yala is revolutionizing Bitcoin’s role in decentralized finance,” said Vicky Fu, Yala Co-founder and CTO. “By issuing Bitcoin-backed stablecoins and creating programmable cross-chain modules, we’re not just enhancing liquidity, but we’re building a bridge that connects Bitcoin to the wider DeFi ecosystem, unlocking unprecedented opportunities for innovation and growth.”

The Road to Mainnet

Yala is set to release its testnet next week, with several key developments planned:

- Testnet V0: $YU stablecoin issuance and Pro Mode.

- Testnet V1: $YU stablecoin Lite Mode with meta yield.

- V1 Release: Insurance module and security upgrades.

- V2 Launch: Governance framework initiation.

Yala’s roadmap focuses on building a robust liquidity layer that connects Bitcoin to major Layer 1 and Layer 2 ecosystems. As the team builds momentum toward the mainnet launch, they encourage the community to participate in the upcoming testnet.

For more information and to stay updated on Yala’s progress, users can visit yala.org.

About Yala

Yala is building a Bitcoin liquidity layer to unlock the full potential of Bitcoin liquidity by connecting it to multi-chain ecosystems. Its modular approach supports deployments on both EVM-compatible platforms and non-EVM systems, aiming to foster a robust and interconnected Bitcoin DeFi ecosystem. Key features of the Yala protocol include an overcollateralized stablecoin protocol, an insurance derivatives service, and a MetaMint functionality, enabling seamless liquidity between Bitcoin and other ecosystems.