Haust Network Delivers Native Yield Through Pioneering Telegram Wallet

Dubai, UAE, June 11th, 2024, Chainwire

The second summer of DeFi has been a long time coming. The complexity and expense of interacting with traditional DeFi protocols has precluded the majority of crypto-interested retail in involving themselves with its most important discovered use case, even if they want to.

On-chain financial activity governed by trustworthy smart contracts has promised the beginning of a new era where everyone is the bank, everyone has the potential to earn appropriate yield, and anyone can access the financial instrumentation they need at any time. All that’s needed is the right access point so that every crypto-user can get involved easily. Haust Network, winner of best DeFi project 2024 at this year’s Crypto Expo in Dubai, aims to be that access point.

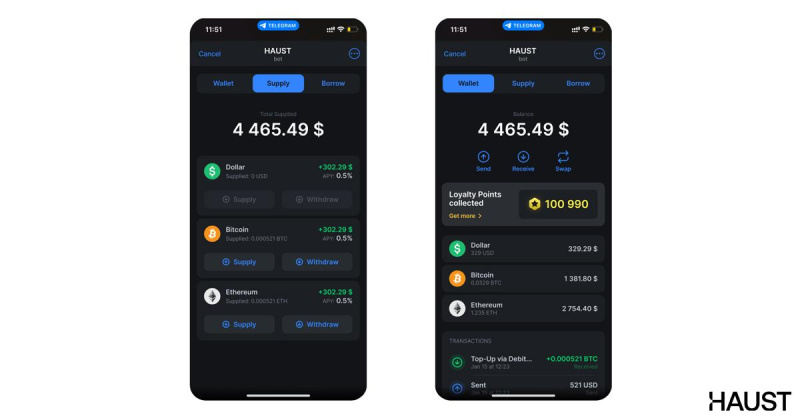

Haust Network Haust Network aims to automatically deliver native yield on all users’ assets held in the Haust Wallet. The Haust Wallet, a Telegram bot operating directly within Telegram, allows users with the chance to earn on their holdings without any additional actions. Additionally, users can maintain access to their crypto assets for payments, on-chain gaming, online services, and other uses without locking them away.

The goal is to enable broad participation in DeFi by creating a seamless integration with various potential yield opportunities across different blockchain ecosystems through a single Telegram wallet. This approach ensures that users can engage with DeFi with minimal required steps.

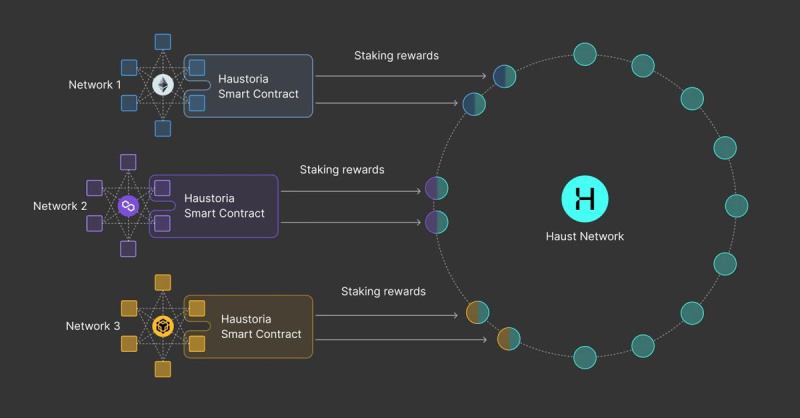

The wallet will automatically sync with Haust Network, an EVM-compatible chain that functions as an Application Absolute Liquidity Layer for crypto holdings. Haust Network aims to deliver yield by deploying user assets in various liquidity staking protocols through Haustoria, an interlinked network of smart contracts. Haustoria functions as an adaptable, multi-valent vault that integrates and interacts with protocols on multiple blockchains through its contracts.

Haustoria will allocate user earnings across various DeFi protocols, seeking to maximize yield while adhering to strategic risk parameters defined by the Haustoria contracts. The earned yield will be distributed automatically and at regular intervals directly into a user’s Telegram wallet, with a small commission. Users are free to spend their yield as they wish, with the funds held on the Haust Network itself. This process is fully automatic, providing users with a seamless experience in accessing DeFi opportunities without complexity.

‘Our network will offer native yield generation through automated processes. We are passionate about using our technology to give every end-user a taste of DeFi’s potential, and fostering broader liquidity through the Ethereum ecosystem and beyond,’ says Anton Patrynika, founder of Haust network.

The Haust Network wallet is available now inside Telegram, with an iOS and Android wallet due to launch soon.

“The aim is to provide a flexible, familiar, all-purpose wallet that earns native yield and introduces the next generation of crypto investors to DeFi,” continues Anton, “so that end-users can discover the power of Haust Network for themselves.”

Considering the recognition Haust Network has received at recent crypto conferences and its user-friendly approach, Haust’s team anticipates that many will start utilizing its services. The Haust mainnet is scheduled to launch in Q4 2024, with plans to integrate multiple Layer 1 blockchains. The Telegram wallet, a mini-app built on Polygon, provides a preview of Haust Network’s capabilities, demonstrating its potential to simplify and enhance access to DeFi for a broader audience.

About Haust Network

Haust Network is an Application Absolute Liquidity Network and will be built for compatibility with the Ethereum Virtual Machine (EVM). Haust to deliver native yield to all user’s assets. Within the Haust Wallet in Telegram after launching mainnet users can spend and earn on their crypto in one easy place, all at the same time. Haust Network will earn yield by leveraging its network of auto-balancing smart contracts that interact across multiple blockchains then effectively channelling their generated yield back to its users.