Inference Labs Raises $2.3 Million in Pre-Seed Funding to Revolutionize AI with Proof of Inference starting with Liquid Staking

Hamilton, ON, April 15th, 2024, Chainwire

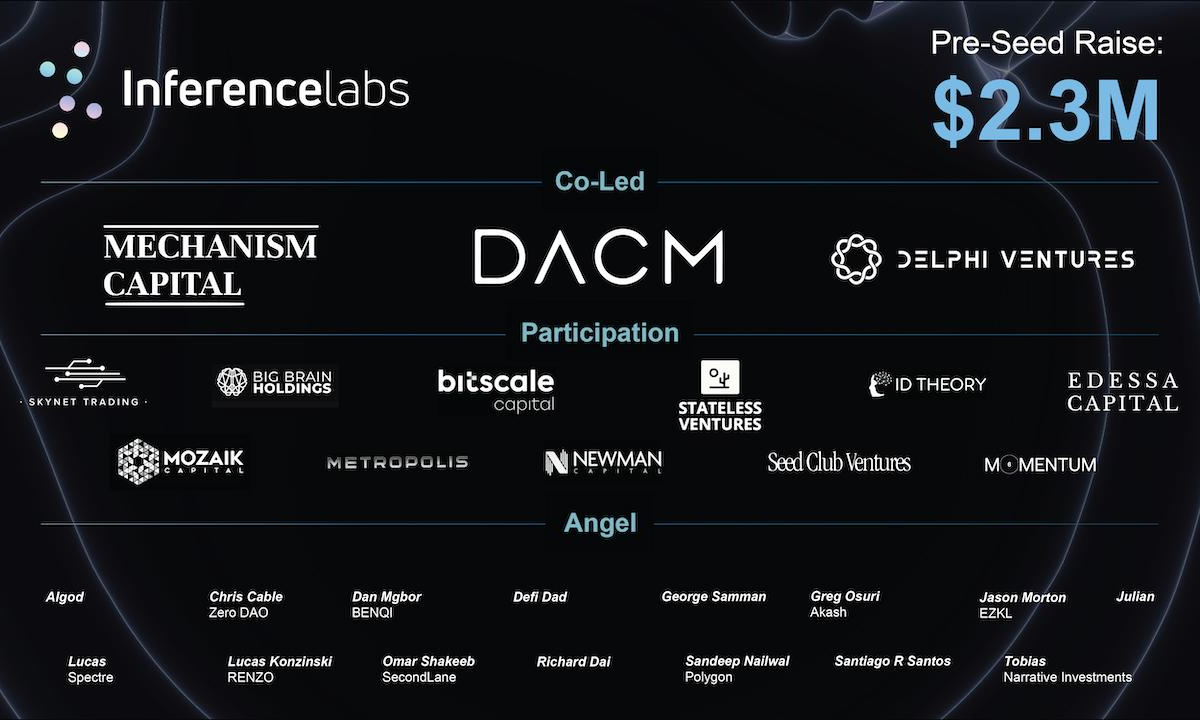

- Inference Labs closes a $2.3 million pre-seed round led by Digital Asset Capital Management, Mechanism Capital, and Delphi Ventures.

- The latest funding round for Inference Labs will boost their innovative AI efforts, focusing on creating a network for efficient AI verification that incorporates Proof of Inference consensus.

Inference Labs, a visionary in combining artificial intelligence (AI) with Web3 technologies, is proud to announce a successful $2.3 million Pre-Seed funding round. The funding was led by Digital Asset Capital Management, Delphi Ventures & Mechanism Capital, with participation from Big Brain Holdings, BitScale Capital, Edessa Capital, ID Theory, Metropolis DAO, Mozaik Capital, Newman Capital, Seed Club Ventures. Industry leaders and builders, Lucas (founder of Renzo Protocol), Dan (founder of BENQI), Kalin (Render), Jason Morton (founder of zkonduit & EZKL), Santiago R Santos, Omar Shakeeb (founder of SecondLane), DeFi Dad, and many others.

This investment is poised to further optimize Inference Labs’ innovative approach to AI, where their work is focused on the development of a network for efficient AI verification with Proof of Inference consensus. The strategic financial support will also help grow the team, and fast-track product development to catalyze an entire ecosystem.

Colin Gagich, Co-Founder and CEO of Inference Labs, emphasizes the urgency to avoid AI’s monopolization stating, “We must lead AI into a new, secure, and accessible era, ensuring it doesn’t fall into the hands of a few, as its power far exceeds that of social media. Decentralized AI isn’t just our goal, it’s a critical necessity for the future.”

Marc Weinstein, General Partner at Mechanism Capital, supports this sentiment: “Inference Labs is not only innovating in AI but is also reshaping how we think about technology. Their work in integrating AI with Web3 is groundbreaking and essential for the next generation of technological advancements.”

Commenting on the funding round, Ronald Chan, Co-Founder of Inference Labs, elaborates on the foundational principles guiding their innovation: “AI’s natural criterion for interoperability would be self-sovereignty within a resilient, decentralized network, incorporating native value exchange into the protocol. New technological primitives must be built with machines, not just humans, in mind. With this funding, Inference Labs will continue to make a substantial impact in this rapidly changing landscape.”

Inference Labs unveils Omron.ai, a pioneering Bittensor subnet #2 that leverages artificial intelligence to redefine the landscape of Liquid Staking Token (LST) and Liquid Restaking Tokens (LRT). Omron stands to incentivize the explosive market by encouraging and rewarding LST and LRT activities. Inference is the moment of truth for a Neural Network, it is only natural that the most successful peer-to-peer intelligence market Bittensor is a perfect training ecosystem for Omron.

At its core, Omron employs a sophisticated ecosystem of smart contracts alongside validator and mining nodes. This system is intricately designed to supply, authenticate, and refine automated liquid restaking strategies on the most prolific staking and restaking platforms such as Renzo, and the Eigenlayer ecosystem. On Omron, individuals choose their favored (re)staking service via our aggregation interface. Participants create a restaked ETH position by contributing LSTs or ETH. This results in the selected (re)staking ERC20 token, which can subsequently be utilized within the Ethereum network to accrue additional rewards while providing training data to the Bittensor Omron Subnet.

The overarching goal is to enhance capital and intelligence markets’ efficiency. By deploying a diverse array of prediction models, Omron not only facilitates in passive Ethereum staking strategies but also pioneers additional restaking opportunities and efficiencies, paving the way for a more dynamic and responsive financial ecosystem.

A novel aspect of Omron is its points incentive mechanism. Contributors who deposit LST or LRTs are awarded points on an hourly basis. This incentivization model encourages users to contribute as they normally would to their selected (re)staking platform. Our audited smart contracts act as an aggregator and all native liquid (re)staking, points, and incentives flow back to the depositor plus Omron points while improving capital efficiency and AVS yield optimization AI models. Extend and continue with additional Liquid (re)staking activity in return for more points! In turn, these contributions fuel the Bittensor Omron subnet with a continuous flow of on-chain LST and LRT performance data and activity, enriching the overall intelligence and liquidity of the system. In a Bittensor first, active validators and miners for the subnet will also receive points for their participation. The Omron subnet is the first Liquid (re)Staking Aggregator that provides depositors direct exposure and rewards to Artificial Intelligence.

Through Omron, Inference Labs is setting a new standard for the integration of AI in the DeFi space, offering a unique and compelling proposition that combines liquid (re)staking with the transformative potential of machine learning with Proof of Inference consensus. This initiative not only showcases Inference Labs’ innovative capabilities but also signals a significant leap forward at the intersection of decentralized finance and artificial intelligence.

About Inference Labs:

Inference Labs Inc. is pioneering the integration of AI with Web3 technology. The company is dedicated to making AI more accessible, secure, and user-friendly, focusing on a decentralized and privacy-centered future, in contrast to conventional centralized systems. Founded in 2023 by Colin Gagich and Ron Chan, Inference Labs is headquartered in Hamilton, Ontario.