Derivatives Exchange Intent X Integrates Orbs Liquidity Hub To Enhance Liquidity For Users

Tel Aviv, Israel, March 26th, 2024, Chainwire

IntentX, a decentralized perpetual exchange, announced its partnership with Layer 3 network Orbs to integrate the latter’s Liquidity Hub. Orbs Liquidity Hub will serve as IntentX’s main spot engine, allowing users access to spot orders and the perpetual contracts marketplace.

Orbs Liquidity Hub is a DeFi infrastructure platform that operates above automated market makers (AMMs). It sources liquidity from on-chain and off-chain to help with the problem of fragmented liquidity across DEXs. The platform aggregates all of the deployed chain’s liquidity and allows DEXs to tap into external liquidity sources to provide better prices than AMMs.

IntentX becomes the latest partner of Orbs Liquidity Hub, joining Quickswap on Polygon, Quickswap on Polygon zkEVM, and THENA on the BNB chain. It also is the first platform on the Coinbase Layer 2 chain, Base, to join the Liquidity Hub, allowing users to get the best prices without going through AMMs and experiencing AMMs’ price impact. Crucially, this marks the first integration of its kind, becoming the first platform on Orbs Liquidity Hub without a DEX AMM.

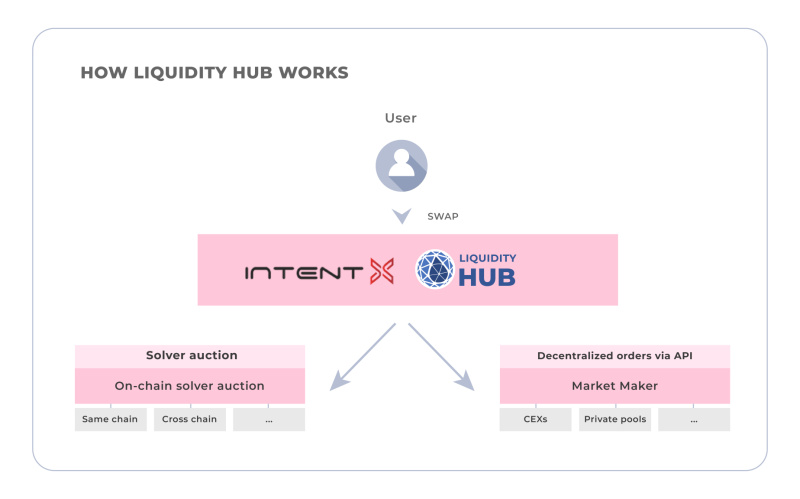

Simply, Orbs Liquidity Hub works by tapping into on-chin and external liquidity sources. Instead of the typical swaps on DEXs – through AMMs, Liquidity Hub sources liquidity from two major sources: On-chain solver auctions and Decentralized orders via its API.

The on-chain solver auctions allow third-party solvers to compete in an auction to fill swaps using on-chain liquidity AMM pools or their own private inventory. Additionally, the Hub integrated decentralized orders from external sources, which are accessible using APIs, enabling institutional/professional traders, such as market makers, to submit bids and compete to fill swaps.

How the Orbs Liquidity Hub will provide liquidity on IntentX (Image: IntentX)

How the Orbs Liquidity Hub will provide liquidity on IntentX (Image: IntentX)

Built by the Orbs project, the Liquidity Hub aims to revolutionize the world of DeFi, operating on complete decentralization, open access without permissions, and composability. With the integration of IntentX, users on the platform will now be able to tap into the full liquidity potential offered by the network, without incurring any additional costs.

About IntentX

IntentX is an OTC derivatives exchange offering perpetual futures trading. The platform is based on the Coinbase Layer 2 chain, Base, bringing forward a combination of technological innovations that usher in the next generation of on-chain finance.

The platform leverages several next-gen innovations to offer omnichain deployment, lower fees, greater liquidity, enhanced capital efficiency, and improved scalability versus current solutions. IntentX launched its open-beta trading platform in November 2023, offering over 250 tradable pairs at launch, each with deep liquidity.

About Orbs Liquidity Hub

Liquidity Hub is a decentralized optimization layer that operates above Automated Market Makers (AMMs). This layer mitigates the problem of fragmented liquidity in DeFi, enabling DEXs to tap into external liquidity sources in order to provide better prices on swaps.

The platform has since been integrated on four chains namelyQuickSwapon Polygon, QuickSwap on Polygon zkEVM, Thena on Binance Chain and IntentX on Base.

About Orbs

Orbs is a decentralized protocol executed by a public network of permissionless validators using PoS, staked with tens of millions of dollars in TVL. Orbs pioneered the concept of Layer 3 infrastructure, by utilizing the Orbs decentralized network to enhance the capabilities of existing EVM smart contracts, opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs, and GameFi.

The platform offers a separate execution layer between L1/L2 solutions and the application layer as part of a tiered blockchain stack, enhancing the capabilities of smart contracts and powering protocols such as dLIMIT, dTWAP, and Liquidity Hub.