Lynex TVL Surges as Dencun Upgrade Sees Linea Capture Market Mindshare

LISBON, Portugal, April 3rd, 2024, Chainwire

The recent Dencun upgrade going live on Linea has seen the network capture the mindshare of the market, bolstering its place as a contender as a top Layer 2. Coupled with Lynex’s series of innovative upgrades, features and partnerships, a new standard for efficiency, user experience, and liquidity has been set in the network’s DeFi ecosystem.

Linea’s Dencun Upgrade: A Game-Changer for L2

The Dencun upgrade introduces a shift in Ethereum’s infrastructure by replacing gas-intensive calldata with lightweight Binary Large Objects (blobs) via EIP-4844, also known as proto-danksharding. This change dramatically improves data availability, reduces the costs of transacting on Ethereum L2s, and alleviates congestion-induced fee volatility. Layer 2 blockchains anticipate fee reductions of as much as 80%, making DeFi more accessible and fostering innovation and growth.

The Dencun upgrade on Linea marks a significant milestone in the evolution of Layer 2 solutions. This transformative update brings lower gas fees and accelerated transaction finality to the Linea blockchain, enhancing its competitiveness and appeal to a broader user base. As Linea continues to gain momentum, the anticipation surrounding its forthcoming token is expected to attract even more attention to this rapidly growing ecosystem.

A Lynex spokesperson stated: “The Dencun upgrade is set to go live on Linea, heralding a transformative shift towards lower gas fees and accelerated transaction finality. As Linea establishes itself as a leading competitive Layer 2 solution, it’s poised to capture widespread attention throughout the year, with the upcoming LXP campaign being the first big event to shake the network. The anticipation surrounding their forthcoming token is expected to bolster this attention further, and Lynex hopes to capitalize significantly on this growth.”

Lynex: Driving Linea’s Liquidity and Growth

Lynex stands at the forefront of the Linea blockchain, driving a significant portion of its Total Value Locked (TVL) and trading volume. Drawing comparisons to the successes of Aerodrome and Velodrome on networks like Base and Optimism respectively, Lynex distinguishes itself with a deep commitment to simplified liquidity provision and community engagement through its rejuvenated ve(3,3) model. Positioned to be Linea’s counterpart to Aerodrome, Lynex is geared up to establish deep liquidity pools and secure substantial support from the Linea community.

As a major contributor to the Linea ecosystem, Lynex serves as the native liquidity layer for Linea. It fulfils this role with advanced liquidity management tools, potential for widespread adoption, and strong LP support. Lynex is dedicated to creating value, addressing the ‘cold start liquidity’ challenge for emerging protocols, and providing established projects with a sustainable approach to liquidity incentives.

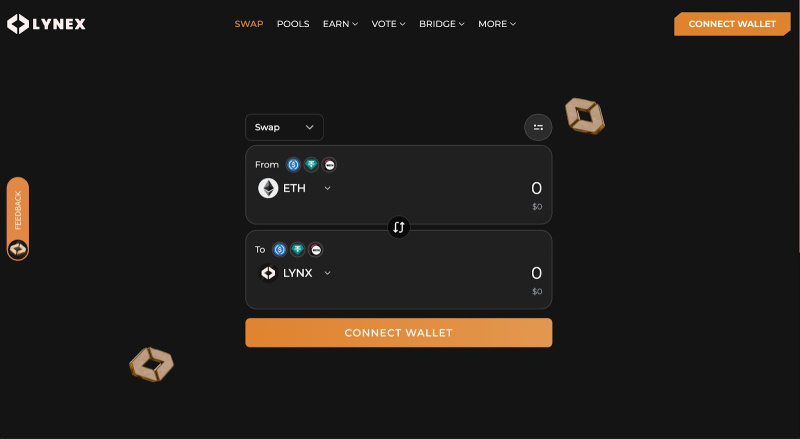

Introducing Lynex’s New SwapUI and Enhanced Routing

Lynex is excited to unveil its new SwapUI, offering users one of the more user-friendly swapping interfaces in the market. This update, coupled with enhanced swap routing in partnership with OpenOcean, ensures the most efficient paths for trades, taking gas fees into account. This optimization means users can now enjoy the best possible routes, minimizing slippage and maximizing efficiency in their transactions.  The team expects this integration to bring many benefits to the Lynex product suite and ecosystem, the team anticipate a surge in trading volume, increased fee generation, and enhanced rewards for $veLYNX token lockers each epoch.

The team expects this integration to bring many benefits to the Lynex product suite and ecosystem, the team anticipate a surge in trading volume, increased fee generation, and enhanced rewards for $veLYNX token lockers each epoch.

The team aims for increased activity that will not only boost overall liquidity on the platform but also provide users with more potential opportunities to earn and capitalize on their investments. Lynex invites users to explore this new feature and experience the optimized trading journey on its platform. Users can search more about Lynex Swap and join Lynex in celebrating this major advancement in its platform’s capabilities!

A New Strategic Partnership with Mendi Finance

In a move to expand its ecosystem further, Lynex has formed a strategic partnership with Mendi Finance. This collaboration includes listing the Mendi token on Lynex, co-marketing efforts, and joint initiatives to drive growth and innovation in the DeFi space.

Mendi Finance is an EVM-compatible lending and borrowing protocol on the Linea blockchain. It offers a fully decentralized, transparent, and non-custodial peer-to-peer lending solution. Inspired by established platforms like Compound Finance and AAVE, Mendi enables users to lend and borrow various supported assets, with initial high-liquidity money markets including wETH, wstETH, wBTC, USDC, USDT, and DAI.

Mendi offers competitive incentives, deep liquidity, and native integration with Linea. Mendi Finance also aims to bridge retail investors with institutional DeFi, unlocking higher yield opportunities and fostering a secure, profitable ecosystem for the next bull run. This strategic partnership is a testament to Lynex’s commitment to fostering a vibrant and diverse financial ecosystem.

Lynex: Setting a New Standard in DeFi

With its recent upgrades and strategic partnerships, Lynex continues to set a new standard for decentralized exchanges. Its focus on user experience, efficient routing, and deep liquidity pools ensures that Lynex remains at the cutting edge of DeFi innovation. As the Linea blockchain and the broader Layer 2 landscape continue to evolve, Lynex is poised to drive growth and adoption in decentralized finance.

About Lynex

Lynex is a liquidity layer, DEX, and blockchain ecosystem built on the Linea blockchain. Focusing on innovation, security, and user experience, Lynex offers a scalable and secure platform for decentralized applications (dApps) and decentralized finance (DeFi) projects. Lynex is also backed by Consensys, the company behind Metamask.